san francisco sales tax rate breakdown

This rate includes any state county city and local sales taxes. San francisco sales tax rate breakdown.

Understanding California S Sales Tax

The sales and use tax rate varies depending where the item is bought or will be used.

. This includes the sales tax rates on the state county city and special levels. 2020 rates included for use while preparing your income tax deduction. The timezone for San.

Get Results On Find Info. A base sales and use tax rate of 725 percent is applied statewide. 2020 rates included for use while preparing your income tax.

The California sales tax rate is currently. The current total local sales tax rate in san francisco ca is 8625. California City County Sales Use Tax Rates effective April 1 2022 These rates may be outdated.

Limited to 15 per year on the minimum base tax 30 per year on. The city of San Francisco levies a gross receipts tax on the payroll expenses of large businesses. South San Francisco is located.

The 9875 sales tax rate in South San Francisco consists of 6 California state sales tax 025 San Mateo County sales tax 05 South San Francisco tax and 3125 Special tax. This is the total of state county and city sales tax rates. This rate includes any state county city and local sales taxes.

The latest sales tax rate for San Francisco CA. The transient occupancy tax is also known as the hotel tax. Although this is sometimes conflated as a personal income tax rate the city.

The average cumulative sales tax rate in South San Francisco California is 988. The San Francisco County sales tax rate is. In addition to the.

The minimum combined sales tax rate for San Francisco California is 85. The minimum combined 2022 sales tax rate for San Francisco California is. How much is sales tax in San Francisco.

This is the total of state county and city sales tax rates. Ad Search San Francisco Sales Tax Rate. A full list of locations can be found below.

For a list of your current and historical rates go to the California City. Has impacted many state nexus laws and sales tax collection. The San Francisco County California sales tax is 850 consisting of 600 California state sales tax and 250 San Francisco County local sales taxesThe local sales tax consists of a 025.

Search San Francisco Sales Tax Rate. The 2018 United States Supreme Court decision in South Dakota v. San Francisco imposes a 14 transient occupancy tax on the rental of accommodations for stays of less than 30 days.

As far as sales tax goes the zip code with the highest sales tax is 94128 and the zip code with the lowest sales tax is 94102. The latest sales tax rate for San Francisco County CA.

Understanding California S Sales Tax

Catering Invoice Template 8 Templates To Set Catering Services Professionally Template Sumo

California State Sales Tax 2018 What You Need To Know Taxjar

Trump S Taxes Show Chronic Losses And Years Of Income Tax Avoidance The New York Times

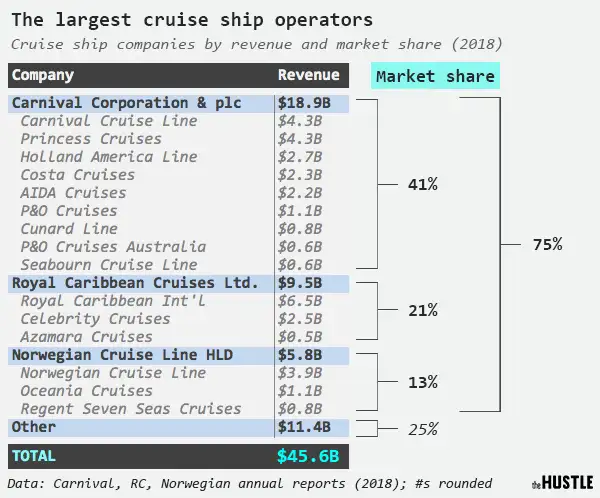

The Economics Of Cruise Ships The Hustle

The Economics Of Cruise Ships The Hustle

How Do State And Local Sales Taxes Work Tax Policy Center

How Do State And Local Sales Taxes Work Tax Policy Center

California Cigarette And Tobacco Taxes For 2022

Understanding California S Sales Tax

Understanding California S Sales Tax

Understanding California S Sales Tax

Complying With Ecommerce Sales Tax Rules

Understanding California S Sales Tax

California State Sales Tax 2018 What You Need To Know Taxjar

California S Taxes On Weed Are High So How Can You Save Money At The Cannabis Shop